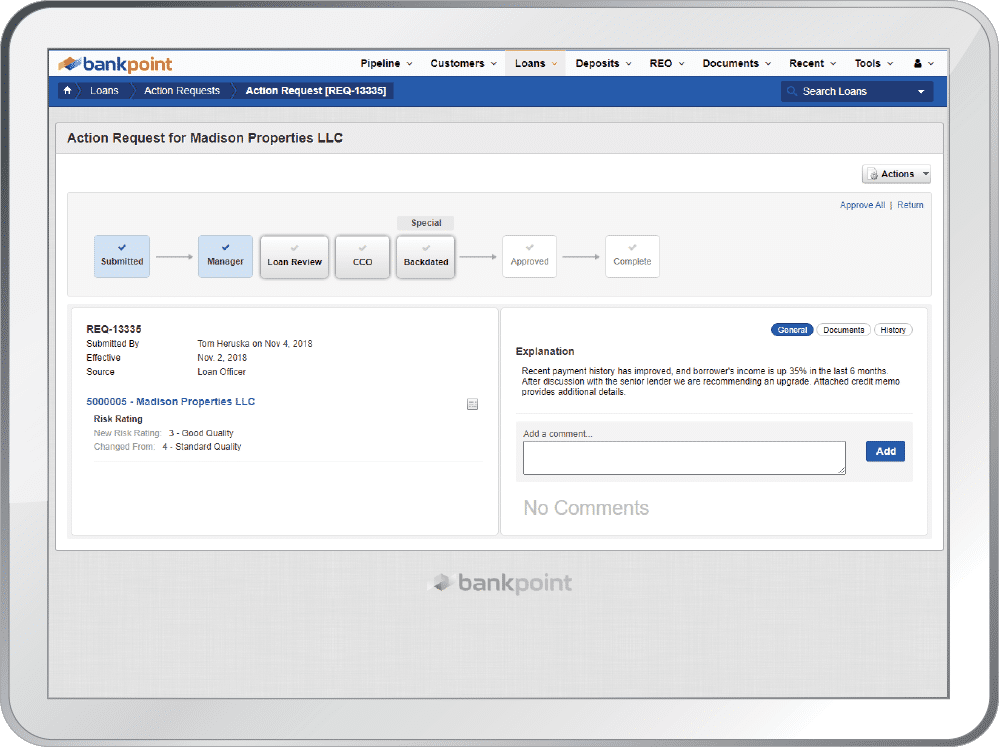

Our customers use BankPoint as the system of record for changes to risk ratings, charge-offs, non-accruals, TDR, and other credit actions.

You define the credit actions, BankPoint controls them. The credit approval process doesn’t have to be time consuming and painful.

Streamline the approval process, improve efficiencies, and make decisions transparent.