Keep everyone on the same page. Dazzle your auditors and examiners with consistent, repeatable processes. Empower your users to produce reports easily, answering questions in minutes instead of days.

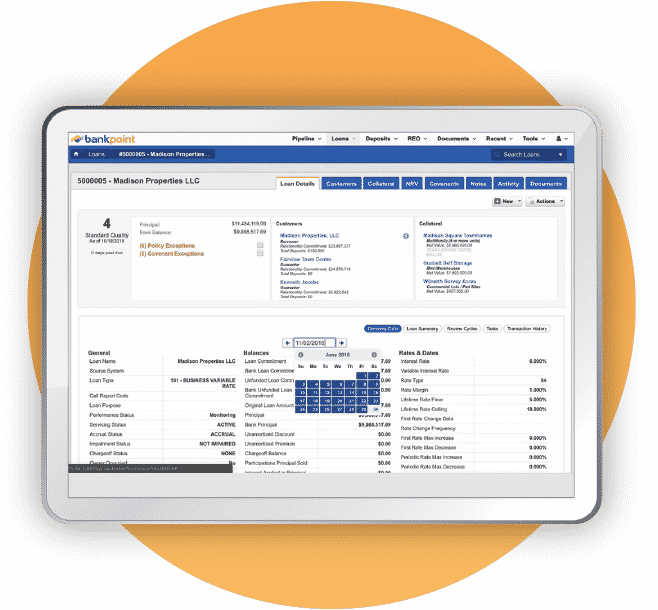

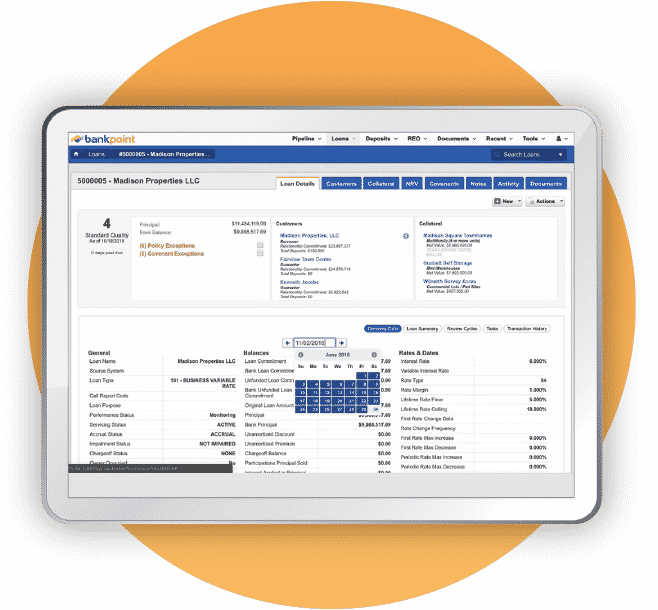

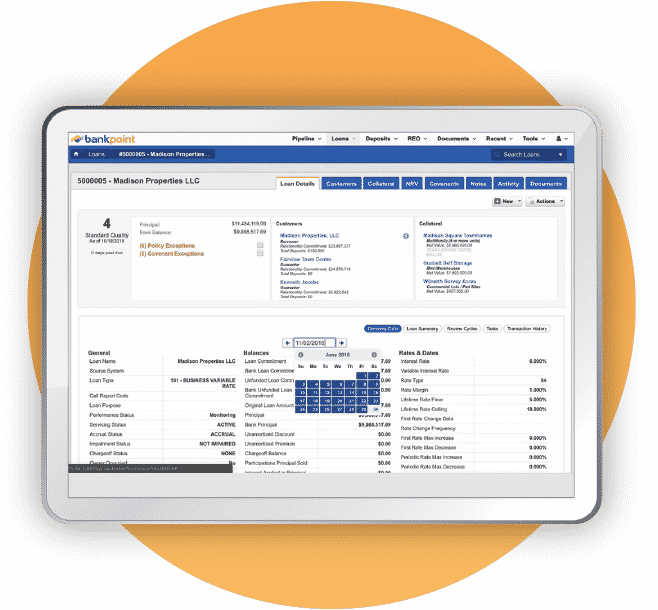

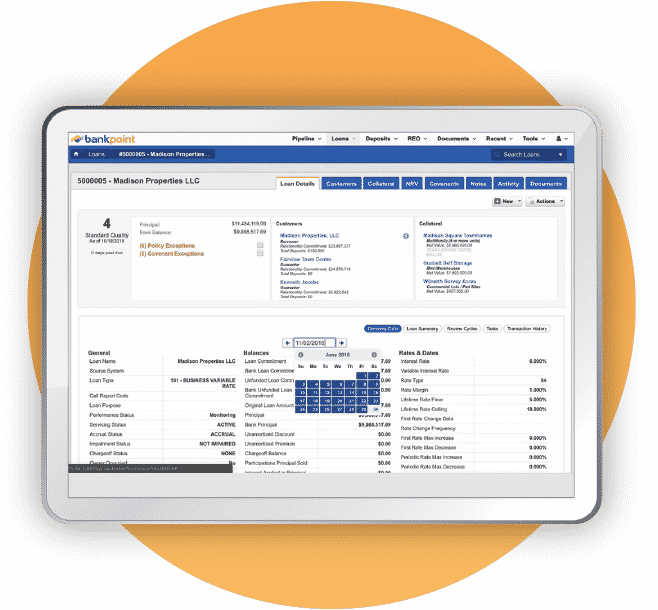

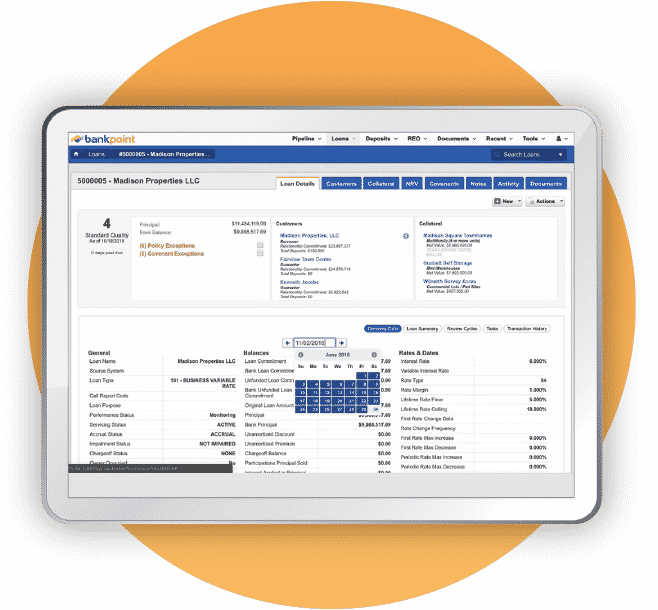

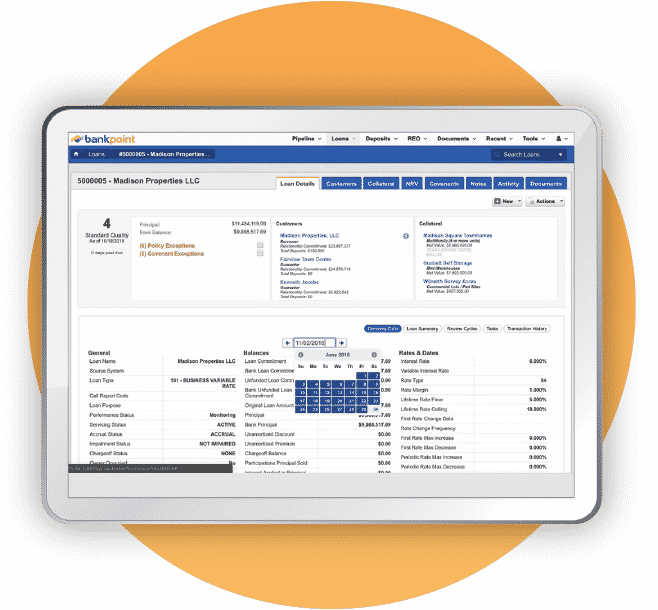

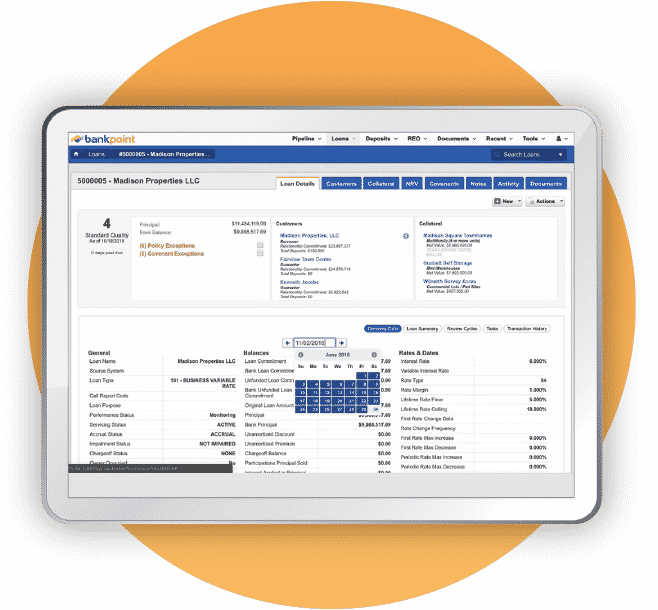

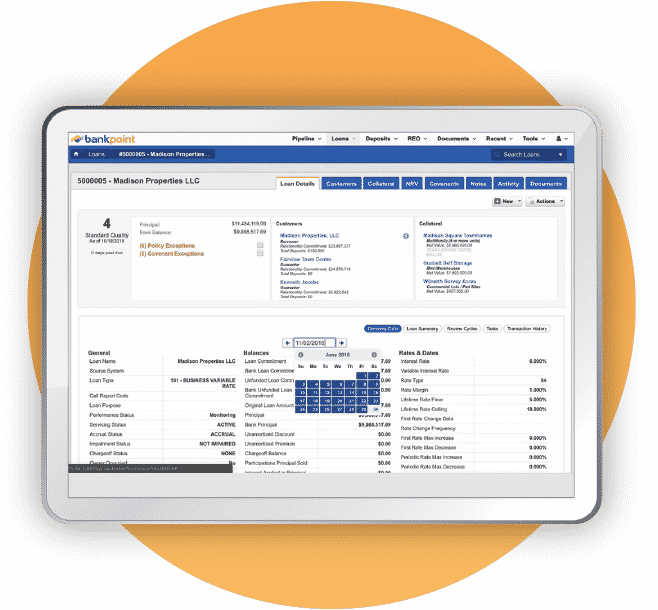

BankPoint is simple and easy to use. Unlike other banking and lending software, our modern and intuitive interface allows for easy adoption with minimal training.

Don’t worry, we’ve got this. We’ll guide you through every step of the BankPoint implementation using our simple 5 step process.

Learn more >

BankPoint is built on the Microsoft Technology Stack and runs in the Microsoft Azure private cloud, providing the infrastructure and security to take user experiences to the next level. For those institutions not ready for the cloud, BankPoint can also be deployed on-premise within your data center.

BankPoint uses a per-user, per-month SaaS pricing model that is affordable for smaller institutions with volume discounts as you grow. Best of all, most modules are included, so you don’t have to purchase additional software as your needs change.

We pride ourselves on providing the best support in the industry, and respond rapidly to all customer requests. BankPoint acts as your partner, providing monthly releases, software enhancements, and bespoke solutions to match your institutions specific needs.